We help families preserve and pass on wealth.

Providence Wealth Systems (PWS) is continuous, integrated, and optimized financial planning system that leverages our Living Benefit Estate Plan (LBEP™) – a proprietary estate planning model with a superior distribution system.

We exist because traditional portfolio construction is failing.

- Client’s #1 risk is not volatility, it’s outliving their assets

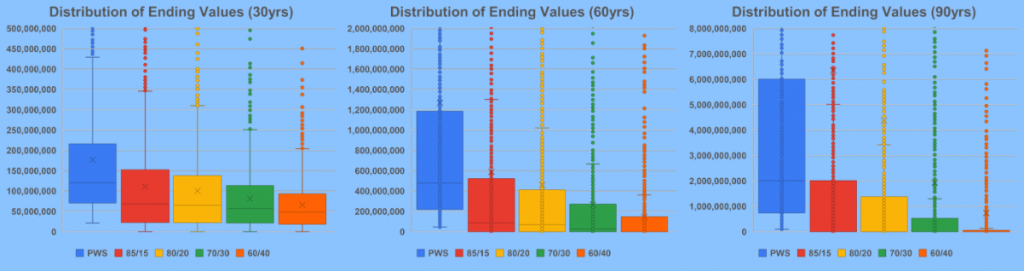

- Traditional portfolios (85/15, 80/20, 70/30, 60/40) run out of assets 10% of the time over a 30 year distribution

- After 60 years, investors exhaust assets 40-50% of the time

- After 90 years, clients are more likely to run out of assets than not.

PWS is the scalable, sustainable solution

Using LBEP™, your clients have the greatest likelyhood of never running out of money. PWS delivers 1% – 3.5% additional CAGR over traditional planning.

01

Competitive Advantage

Adapting strategies used by the Rockefeller family, banks, and >70% of fortune 1000 companies, PWS is able to mitigate short-term risk while improving long term performance

02

Automation and A.I.

03

Planning

Over time, assets are gradually shifted to trusts to minimize estate taxes and protect wealth for future generations

First-to-world Continuous Financial Planning Software

LBEP™ helps families preserve wealth with superior estate planning, providing certainty in uncertain times, and building financial legacies.

Providence Wealth Systems is founded by experts with backgrounds in Investment Banking, Private Equity, Strategy Consulting, and Retail Financial Advisory, along with technology leaders specializing in advanced analytics, ML, AI, and application development.

Part of me wishes I didn't talk to you because the problem with truth is that you can't unsee it. It's a privilege to meet the [group] who is going to change the industry before you do it.

Wealth Management Advisor

$900mm+ AUM,

Private Bank & Pension Fund Manager

Have a question?

Let’s start a conversation. Tell us about yourself and send your question. We’ll get back to you as soon as possible.